UNS — Universitas Sebelas Maret (UNS) Surakarta, Center for Fintech and Banking, hosted a joint workshop entitled “Digital Transformation Islamic Finance Green Economy” on Tuesday (24/5/2022). The virtual event through the Zoom Cloud Meeting was conducted in collaboration with Hamad Bin Khalifa University (HBKU) Qatar. Prof. Dr. Jamal Wiwoho, SH, M.Hum., Rector of UNS, was also present at this event. In his remarks, he hoped that this event could be useful for participants. “Hopefully, this event will benefit the attendees,” said Prof. Jamal.

The event presented four presenters. The first presenter Dr. Aldy Fariz Achsanta from UNS discussed his research article entitled ‘Disclosure of Related Party Transactions, Business Group Affiliation, and The Cost of Debt.’ In his presentation, he explained that risk premium is only imposed on borrowers with poor credit ratings. Meanwhile, profitable related party transactions are usually associated with higher debt charges. Furthermore, he explained that this could happen when the ultimate owner has lower voting rights and when there are several large shareholders in a corporation. This situation can also happen when the borrower is in countries with stronger creditor rights or stronger shareholder protection.

The second presenter, Mustafa Disli from HBKU, reviewed an article entitled ‘Favoring the Small and the Plenty: Islamic Banking for MSMEs.’ He stated that based on the research conducted, he found that Islamic banks were strongly involved in the loan distribution to the Small and Medium Enterprises (SMEs) sector after controlling for the effect of bank characteristics. Sharia banks also tend to diversify their loan portfolios to SME financing. Moreover, non-performing loans in Islamic banks are no different from cases found in other conventional banks. Finally, Islamic bank financing is positively correlated with economic growth. “Since SMEs are the backbone of economic development, our findings implicitly reveal that Islamic bank financing is positively correlated with growth,” he explained.

The discussion was followed by a presentation from Zhamal Nanaeva from HBKU, with an article entitled ‘Open Banking in Europe: The Impact of the Revised Payment Services Directive on Solarisbank and Insha.’ In her material presentation, she stressed that academics should play an important role in developing new ecosystems and driving open debates around customer data. “Academics should play an important role in developing new ecosystems and driving open debates about customer data. Therefore, further research should be conducted in areas related to new regulations and the challenges in the transition to new value creation methods,” she explained.

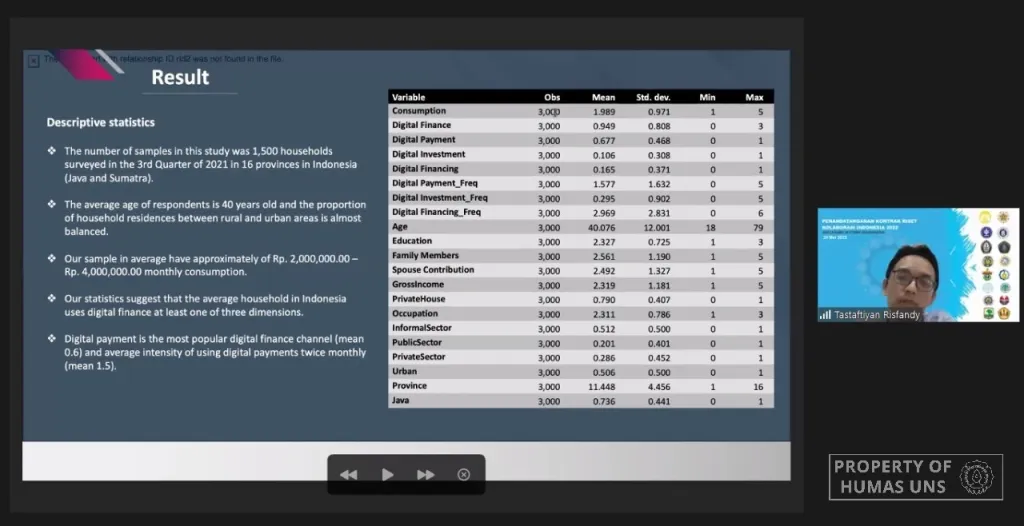

The last article was presented by Dr. Tastaftiyan Risfandy from UNS with an article titled “Digital Finance, Household Consumption, and Covid-19 Pandemic: Evidence from Indonesia.” Supporting some previous studies, he explained that digital finance had been empirically proven as a means to increase household consumption that could ultimately increase financial inclusion and economic growth. In contrast, the insignificant impact of Covid-19 can indicate the success of government programs such as the National Economic Recovery during the Covid-19 pandemic to reduce Covid-19 negative impact on the economy. Humas UNS

Reporter: Zalfaa Azalia Pursita

Editor: Dwi Hastuti